Supply Issues Driving Copper

Copper prices are pulling back mid-morning after the futures market spiked to fresh all-time highs earlier in the session. Fears over the threat of new US tariffs on metals have been a key upside driver recently following warnings from Trump and copper prices have risen despite a stronger US Dollar. Indeed, with warnings recently over the risk of outsized copper demand this year, the metal has outperformed others in the sector and looks set to continue to do so. News this week of big disruptions at key South American mines have added to these supply concerns as extreme weather conditions, worker’s strikes and political issues have contributed to reduced output.

Cash/Futures Spread Supportive

Despite the pullback, copper prices should remain supported near-term according to a research note from Sucden. Analysts there point to a continued premium in cash copper above the 3-month futures rate. While this spread remains, copper futures should find strong support into any pullback.

USD & The Fed

On the USD front, slightly softer inflation data yesterday is supportive for copper prices also. USD has been a little weaker on the back of the data and could soften further if today’s PPI & retail sales readings show any similar weakness. On the other hand, any upside surprise today should fuel a fresh weakening of Q1 rate-cut expectations and could cap copper for now as USD rebounds higher.

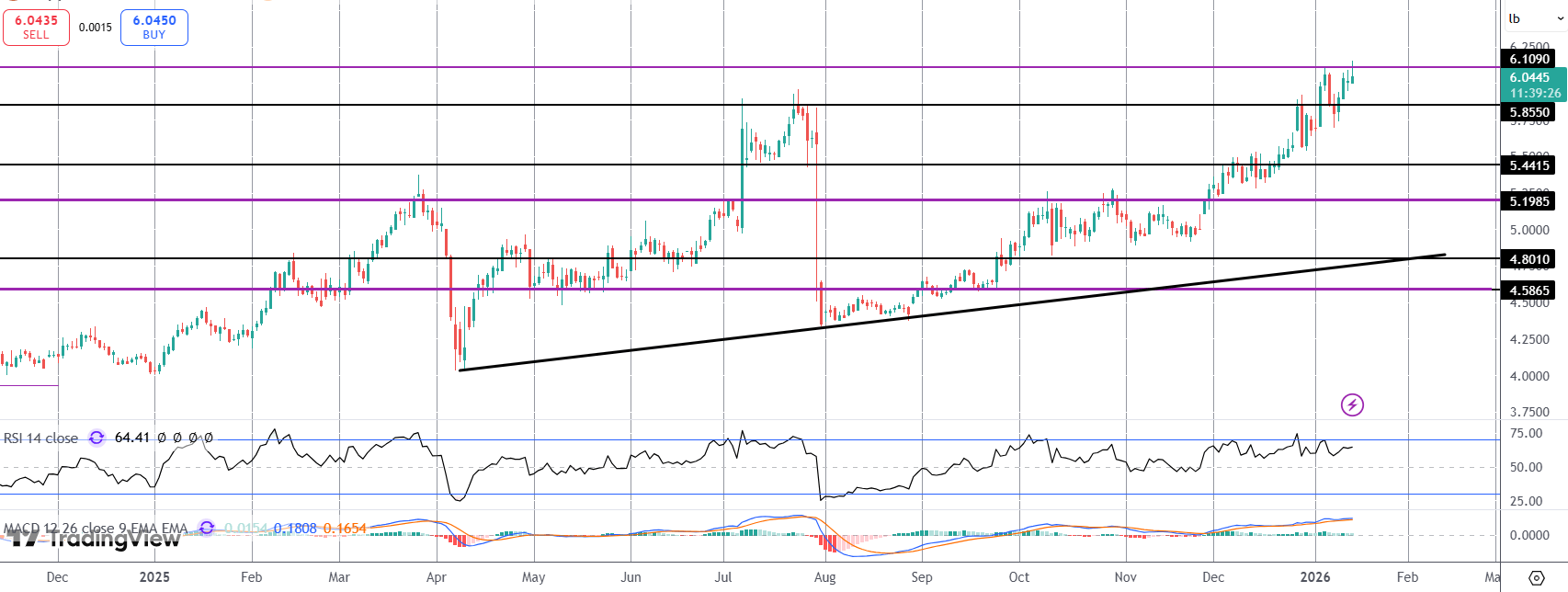

Technical Views

Copper

For now, copper prices remain capped into the 6.1070 level which continues to hold as resistance. Bearish divergence in momentum studies through recent highs suggest potential for a pullback near-term. 5.8550 remains key support to note with the bull outlook remaining intact while price holds atop that level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.