Bitcoin Breaks Above Key Level

BTC Breaks Key Level

Bitcoin prices are on watch today after the futures market surged higher yesterday, breaking out above the $94,500 level which had capped the market since November. The move comes amidst uncertainty around a long-awaited crypto bill which seeks to create a regulatory framework around the crypto market. The bill was proposed earlier in the week and was expected to be debated today by the Senate Banking Committee. However, that debate has been delayed for now after leading crypto exchange Coinbase pulled support for the bill, urging adjustments after it claimed the current bill would benefit banks and not the crypto industry.

Wider Mainstream Support for BTC

Despite the delay, the bill is still widely expected to pass through the Senate this year and should usher in a new era for the wider crypto market as it moves further into the mainstream. The approval of Bitcoin ETFs by the SEC early last year marked a major milestone for Bitcoin and saw prices firmly higher initially before macro drivers fuelled a reversal over Q4. Looking ahead, however, there is plenty of room for a fresh influx of ETF demand to drive BTC higher with many players looking for a fresh breakout in Bitcoin this year along with a surge in the broader crypto space. Any news regarding alterations to the bill, and particularly if Coinbase offers its support, should see BTC prices spiking near-term.

Technical Views

BTC

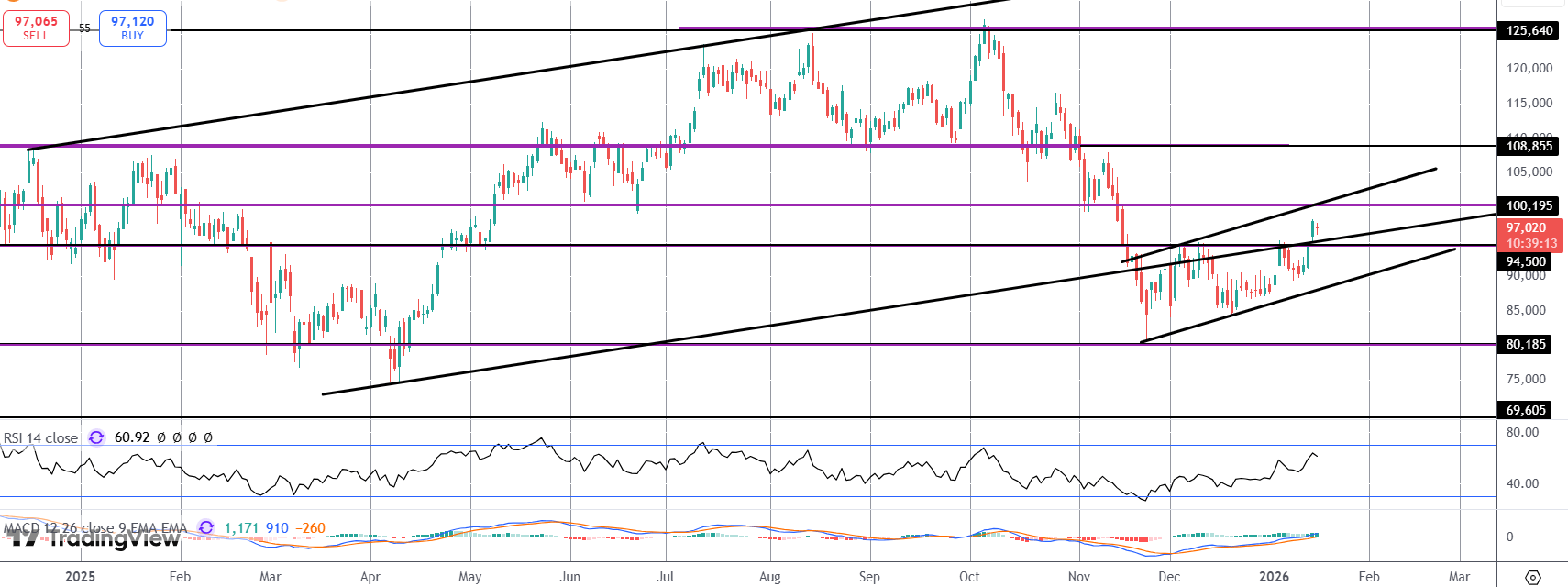

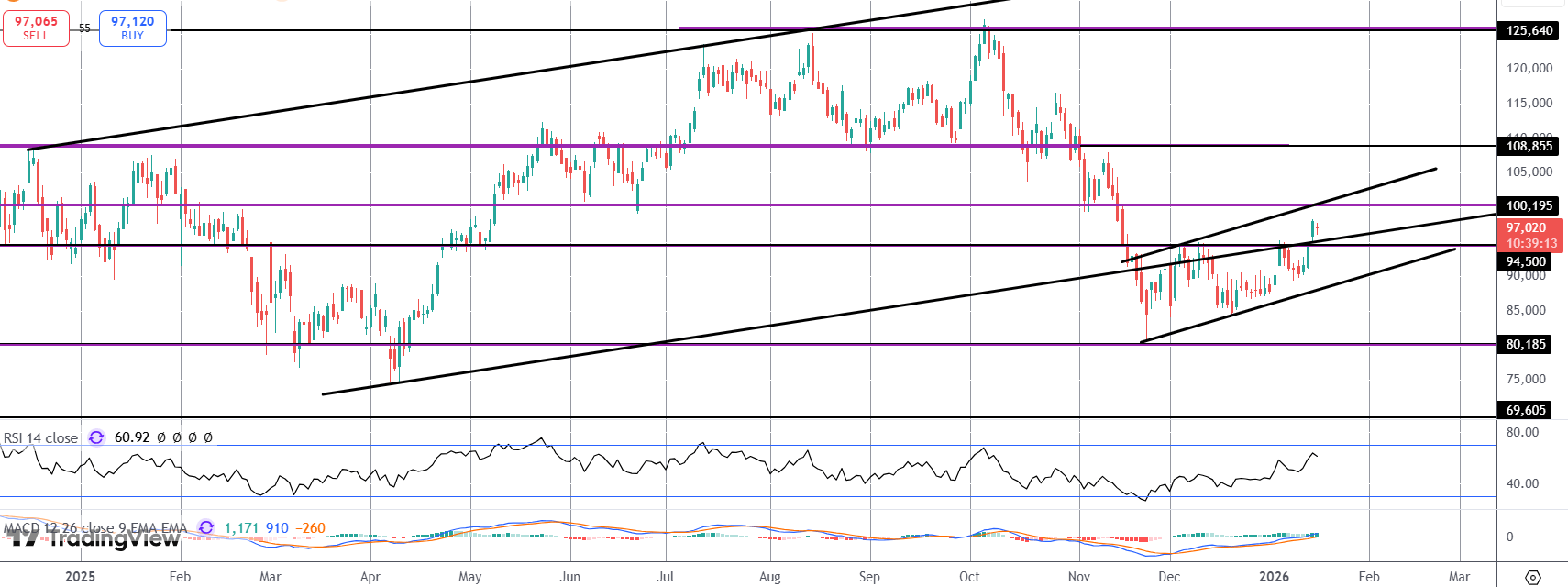

The rally has seen price breaking above the $94,500 level and back above the wider bull channel lows. For now, the $100k mark remains the key marker for bulls to break to alleviate any near-term downside risks. Above there, focus turns to $108,855 as the next big test.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.