SP500 LDN TRADING UPDATE 9/1/26

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

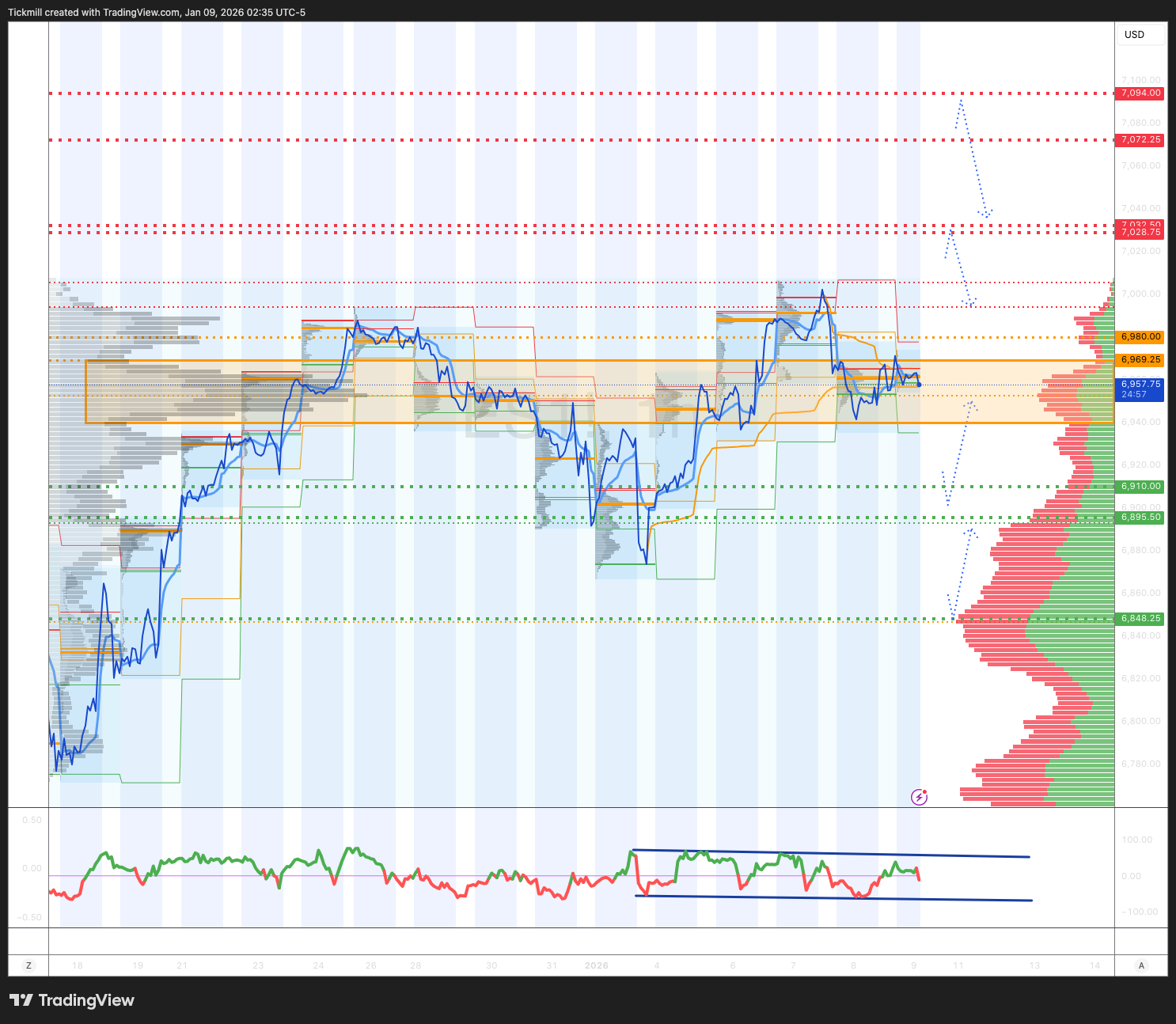

WEEKLY BULL BEAR ZONE 6970/80

WEEKLY RANGE RES 6984 SUP 6817

JAN OPEX STRADDLE 6661/7008

MAR QOPEX STRADDLE 6466/7203

DEC 2026 OPEX STRADDLE 5889/7779

WEEKLY VWAP BULLISH 6882

MONTHLY VWAP BULLISH 6845

WEEKLY STRUCTURE – BALANCE - 6866/6994

MONTHLY STRUCTURE – ONE TIME FRAMING HIGHER - 6775

The SPX aggregate gamma flip region is around 6870. The upside gamma rises sharply from 6930 and above. Conversely, below 6770, it drops sharply to the downside

DAILY STRUCTURE – BALANCE - 7006/6932

DAILY VWAP BEARISH 6963

DAILY BULL BEAR ZONE 6930/40

DAILY RANGE RES 7032 SUP 6910

2 SIGMA RES 7094 SUP 6848

VIX BULL BEAR ZONE 17.7

PUT/CALL RATIO 1.15

TRADES & TARGETS -CAUTION ON POTNETIAL HIGH VOL EVENT RISK WITH SCOTUS DECISION

PRIMARY PLAY - LONG ON REJECT/RECLAIM DAILY RANGE SUP TARGET 6950

LONG ON REJECT/RECLAIM 2 SIGMA SUPPORT TARGET 6895

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEW - “CHOPPY (CONT’D)”

S&P closed +1bp at 6,921 with a Market-on-Close (MOC) of $180mm to SELL. The Nasdaq 100 (NDX) dropped -57bps to 25,507, while the Russell 2000 (R2K) rose +111bps to 2,604, and the Dow gained +55bps to 49,266. A total of 17.1 billion shares were traded across all U.S. equity exchanges, compared to the year-to-date daily average of 16.86 billion shares. The VIX climbed +46bps to 15.45, WTI Crude surged +475bps to $58.63, the U.S. 10-Year yield increased +3bps to 4.18%, gold rose +39bps to 4,474, the DXY strengthened +23bps to 98.92, and Bitcoin edged up +6bps to $91,062.

Market activity normalized today, but there was notable rotation across sectors, with longer-duration and speculative areas under pressure. One-off idiosyncratic stories, muted conviction ahead of earnings, and fresh Trump headlines following the Non-Farm Payrolls (NFP) report and the potential IEEPA decision tomorrow contributed to the mixed sentiment. For NFP, expectations are for a headline print of 70k, aligning with street consensus, though whispers suggest a potential beat. The market is pricing in two rate cuts this year, with the first 25bp cut expected around April 29 unless a significant surprise shifts expectations.

Regarding the potential IEEPA decision, the Supreme Court's session begins at 10 am tomorrow. After administrative proceedings, opinions will be read, with the press receiving updates simultaneously. Three potential outcomes are expected: no tariffs, partial tariffs, or full tariffs, though the latter is seen as least likely. There will be a delay between the announcement of the decision and any implementation.

Consumer flows were notable today, with a skew toward buying rather than the two-way re-grossing observed earlier in the week. Both hedge funds (HF) and long-only (LO) investors engaged in accumulation, focusing on retail/discretionary stocks (+6% YTD) and staples, driven by COST’s strong performance and STZ’s positive earnings beat, coupled with low ownership levels in these groups. Sentiment suggests it’s challenging to maintain short positions ahead of the IEEPA decision and the ICR event early next week, where favorable commentary is anticipated, particularly for Softline/apparel names.

Overall activity levels were moderate, rated a 6 on a 1-10 scale. Our floor ended +63bps to buy, compared to a 30-day average of -48bps. Asset managers were slight net buyers, favoring consumer discretionary and staples, industrials, and tech, while reducing exposure to macro expressions. Hedge funds were slight net sellers, primarily in tech and communication services.

Notable movers included RVMD, which surged +20% after hours following reports that Merck discussed a $28B-$32B price for Revolution Medicines (per FT). INTC rose +2.5% post-market after a Trump tweet highlighting Intel’s launch of the first sub-2 nanometer CPU processor made in the U.S. and the government’s significant financial gains through its ownership stake in Intel. Trump also announced plans to instruct representatives to buy $200 billion in mortgage bonds to lower mortgage rates and make homeownership more affordable.

On derivatives, equities are expected to trade risk-on if IEEPA tariffs are struck down. RSP volatility was a focus today, significantly outperforming alongside spot levels. Short-dated downside is trading above SPX volatility, making RSP vol selling structures appealing. The RSP March 175/205/215 call spread collar at 70 cents (ref 196.9) is an attractive implementation. With earnings season approaching, potential upside is seen in names like HOOD, META, UNH, and LVS, with implementations available. The S&P implied move through tomorrow’s close was ~65bps. (Credit: Shayna Peart)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!