Post-FOMC Dollar Bounce Continues

USD Bounce Continues

The Dollar continues to grind higher as we push towards the weekend. DXY has rebounded firmly off the post-FOMC lows and is now around 2% higher. The fallout from the FOMC has left USD bears a little underwhelmed. While the Fed cut rates as expected as signalled the likelihood of further easing, projected rate cuts were less than the market was looking for, leading to a squeeze higher in USD. Powell was concerned over the weakness in the jobs market but equally concerned over lingering inflationary risks. As such, traders are aware that a continue rise in inflation could derail easing plans with Powell noting that each decision will come on a meeting-by-meeting basis.

USD Data in Focus

Looking ahead, USD will now be mainly driven by incoming economic data. Given the uncertainty in the Fed’s outlook, any upside surprises should dampen easing expectations further, leading to a higher Dollar rate. This reaction was clear yesterday as weekly jobless claims came in below forecasts. In particular, any further upside in inflation readings will be a firm bullish catalyst for USD, causing the biggest headwinds for easing projections. On the other hand, any US data weakness should see traders ramping up easing expectations, putting fresh pressure on the greenback. Ideally, doves want to see a drop in inflation which would be heavily bearish for USD given that this is the main roadblock for the Fed in terms of turning more dovish.

Technical Views

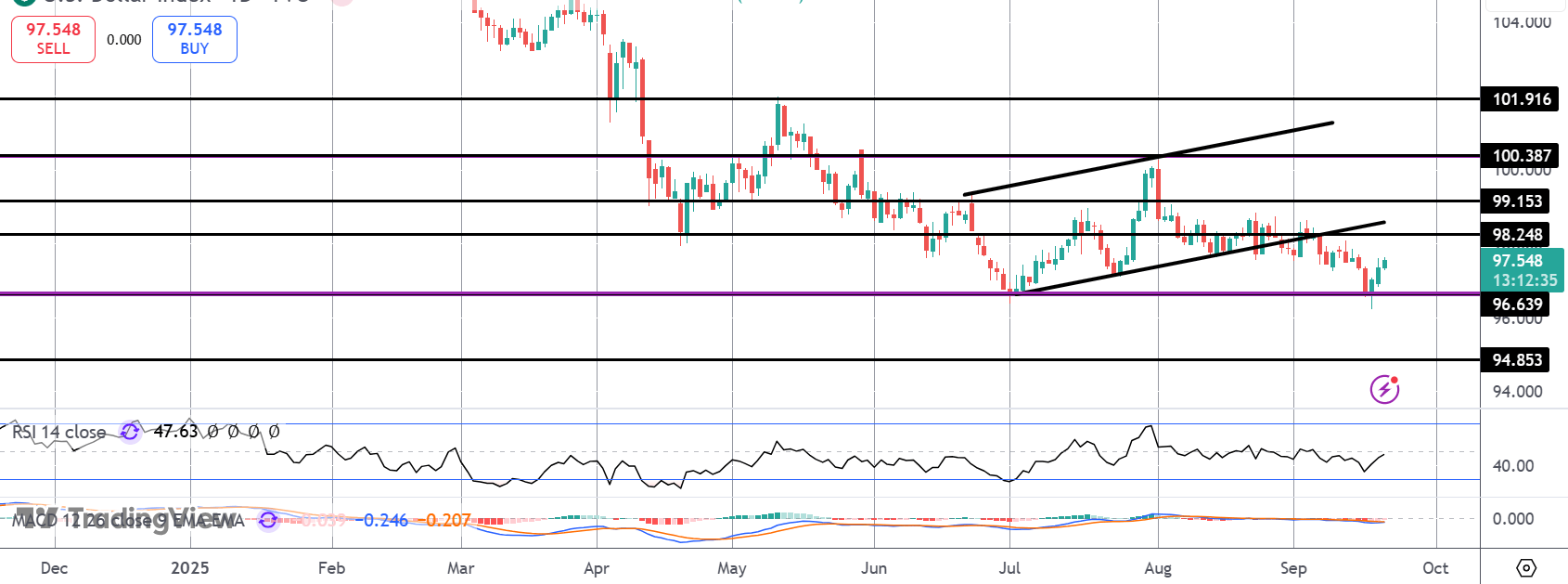

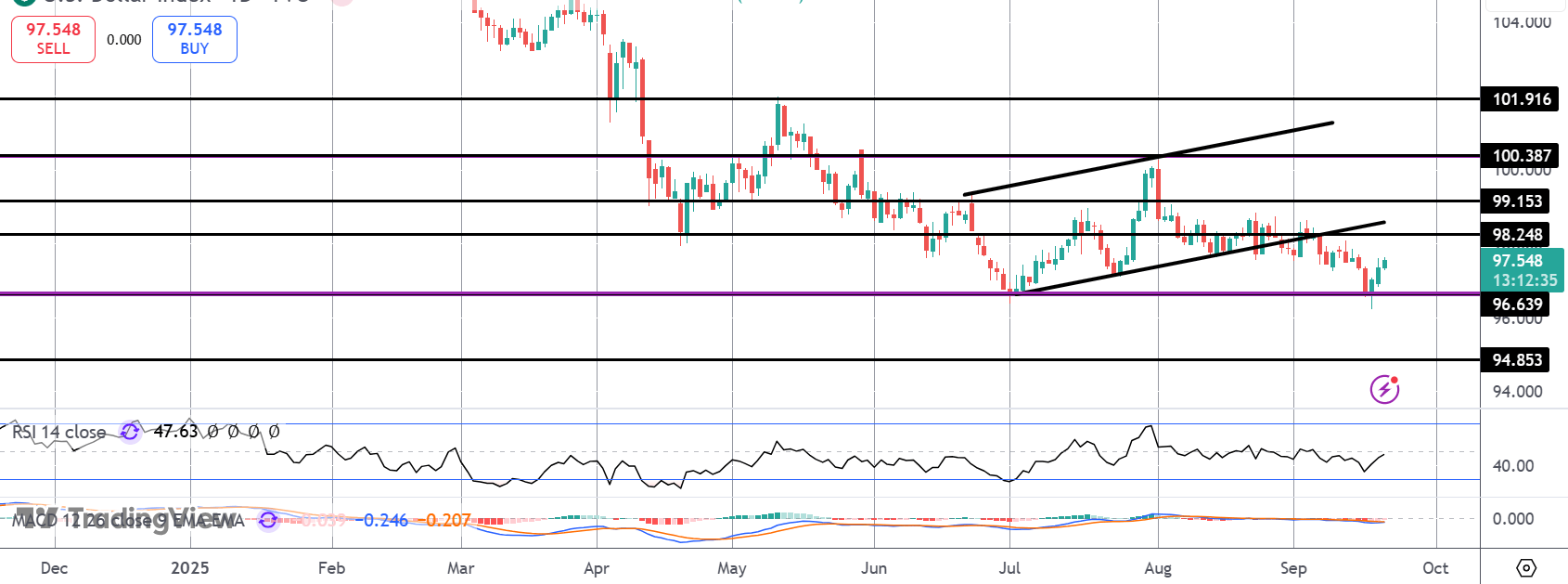

DXY

The sell off in DXY has stalled for now into a retest of the YTD lows around the 96.63 with price reversing higher from here. Momentum studies are turning up off lows too suggesting there could be room to push higher if bulls can get back above the 98.24 level. The retest of the broken bull channel will be a big test in that area also. To the downside, 94.85 is the deeper bear target to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.