2026: Weighing It Up

We anticipate the broad USD to face softer conditions in 2026, driven by the Fed’s easing bias. A weaker USD environment provides support for other currencies.

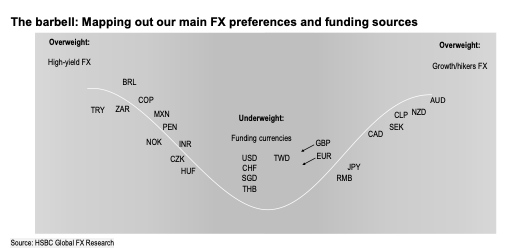

Our longstanding preference remains with quality, high-yielding EM currencies and growth-oriented currencies, particularly those whose central banks are approaching hiking cycles. Specifically, we continue to favor much of the LatAm FX complex, though we acknowledge potential volatility due to regional political developments. Nonetheless, we maintain a constructive view of this region, alongside other high-yielding currencies like the ZAR and TRY. For growth-oriented currencies, we sustain our preference for the AUD, NZD, and SEK.

A key difference this year is that the funding sources for our favored currencies are expected to diversify beyond just the USD. While the USD is likely to stay soft, another significant wave of weakness seems unlikely as the Fed’s rate-cutting cycle could conclude amid signs of resilience in the US economy. This makes the USD a less obvious funding currency, opening the door for others to take on this role. For instance, we should consider currencies with low yields such as the EUR, SGD, TWD, THB, and CHF. Additionally, the BoE’s ongoing easing cycle will likely continue to weigh on the GBP. These dynamics present intriguing opportunities to position our preferred currencies against these low-yielding alternatives.

Working it Out

Bringing all elements together, we believe a barbell-type approach encapsulates our perspective (refer to the chart on the previous page). However, we also draw on an earlier framework to explain why we favor certain currencies over others within this barbell strategy.

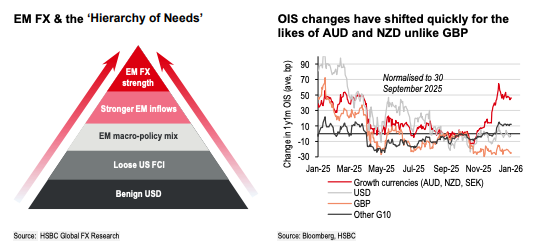

As long as global growth remains steady, the Federal Reserve refrains from rushing into rate hikes, and U.S. financial conditions stay relatively loose, the USD is likely to remain on the softer side. This creates a supportive environment for emerging market (EM) foreign exchange (FX) and other cyclical currencies, as highlighted in our ‘Hierarchy of Needs’ framework (refer to the chart above and see ‘In the Mix for 2026’, EM FX Roadmap). If local factors, such as robust EM growth conditions and sound macroeconomic policies, also show improvement, we could see a resurgence in portfolio inflows. This would place certain EM currencies in a stronger position, making them more likely candidates for currency appreciation.

Leveraging this framework, we continue to favor many Latin American (LatAm) and Central and Eastern Europe, Middle East, and Africa (CEEMEA) currencies over those in Asia. Some attribute the outperformance of these regions to high yields coupled with low cross-asset volatility, which is partially true. However, it also reflects prudent policy measures, as evidenced by relatively high real yields, particularly in LatAm. Furthermore, fiscal risks appear less concerning, supported by a downward trend in credit default swap (CDS) spreads in both LatAm and CEEMEA.

This broader perspective on FX opportunities highlights the potential advantage of shorting developed market currencies facing fiscal challenges, political and policy uncertainty, and/or weak growth prospects (USD, EUR, GBP, CAD, JPY) in favor of EM currencies with improving policy frameworks. A comparison of yield curve slopes between developed markets and EM underscores this point. In our view, the flattening of EM yield curves cannot solely be attributed to a weaker USD. Instead, they reflect stronger fiscal outlooks, recovering growth, and the likelihood of tighter monetary policies—currencies like the AUD, NZD, and potentially the SEK come to mind. Conversely, developed market currencies such as the USD, EUR, GBP, and JPY fail to meet these criteria confidently.

Lastly, we are often asked what factors could shift our view, particularly regarding the broader USD. As discussed in our latest Currency Outlook, if expectations of Fed rate cuts were to dissipate, this could stabilize the USD. However, this alone may not be sufficient to drive significant USD strength, especially if other central banks are perceived to be raising their policy rates. A more plausible scenario for a strong USD resurgence would involve the Federal Reserve initiating a hiking cycle much earlier than anticipated, at a time when markets have largely priced in tightening elsewhere or are expecting rate cuts. However, we believe this scenario presents a high threshold for the USD to achieve in 2026.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!